The tax pros are what make SDIRAs interesting For most. An SDIRA could be both classic or Roth - the account sort you decide on will rely largely with your investment and tax system. Examine using your monetary advisor or tax advisor if you’re Uncertain which is ideal for you.

As an investor, having said that, your choices are certainly not limited to shares and bonds if you select to self-immediate your retirement accounts. That’s why an SDIRA can remodel your portfolio.

Have the liberty to take a position in Practically any type of asset having a risk profile that matches your investment system; which includes assets which have the probable for a better price of return.

No, you cannot put money into your own personal business by using a self-directed IRA. The IRS prohibits any transactions between your IRA along with your have enterprise simply because you, given that the owner, are thought of a disqualified man or woman.

Yes, property is one of our clientele’ most favored investments, from time to time identified as a real-estate IRA. Clients have the option to invest in anything from rental Homes, industrial real estate, undeveloped land, property finance loan notes and even more.

An SDIRA custodian differs as they have the appropriate personnel, skills, and capacity to keep up custody from the alternative investments. The initial step in opening a self-directed IRA is to find a company which is specialised in administering accounts for alternative investments.

The key SDIRA regulations within the IRS that traders require to grasp are investment limitations, disqualified persons, and prohibited transactions. Account holders ought to abide by SDIRA principles and laws in an effort to protect the tax-advantaged status in their account.

Consider your Close friend might be setting up the subsequent Facebook or Uber? By having an SDIRA, you'll be able to put money into will cause that you believe in; and most likely get pleasure from greater returns.

Bigger Service fees: SDIRAs often include greater administrative prices compared to other IRAs, as selected facets of the administrative approach cannot be automatic.

Put basically, if you’re searching for a tax efficient way to develop a portfolio that’s a lot more personalized in your pursuits and knowledge, an SDIRA could be the answer.

SDIRAs will often be utilized by palms-on investors who are ready to tackle the hazards and obligations of choosing and vetting their investments. Self directed IRA accounts can be perfect for traders who definitely have specialised knowledge in a distinct segment marketplace they wish to spend money on.

Variety of Investment Alternatives: Make sure the company permits the types of alternative investments you’re keen on, for example property, precious metals, or personal equity.

As soon as you’ve found an SDIRA supplier and opened your account, you could be questioning how to truly start out investing. Understanding the two The principles that govern SDIRAs, and tips on how to fund your account, may also help to put the muse for a way forward for successful investing.

Regardless of whether you’re a monetary advisor, investment issuer, or other money Skilled, explore how SDIRAs could become a strong asset to develop your company and my latest blog post reach your Skilled goals.

Producing one of the most of tax-advantaged accounts lets you preserve more of The cash which you invest and earn. Based on no matter if you select a standard self-directed IRA or even a self-directed Roth IRA, you have got the possible for tax-totally free or tax-deferred advancement, supplied selected circumstances are fulfilled.

Numerous investors are shocked to understand that applying retirement money to speculate in alternative assets has actually been possible given that 1974. Nevertheless, most brokerage firms and banking institutions center on offering publicly traded securities, like shares and bonds, because they absence the infrastructure and skills to handle privately held assets, including real estate or non-public equity.

Real estate property is one of the most well-liked choices among the SDIRA holders. That’s due to the fact you are able to put money into any sort of real-estate with a self-directed IRA.

Often, the fees linked to SDIRAs can be larger plus more complex than with an everyday IRA. It's because of the improved complexity connected to administering the account.

Adding dollars directly to your account. Bear in mind contributions are subject matter to once-a-year IRA contribution restrictions set from the IRS.

Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Catherine Bach Then & Now!

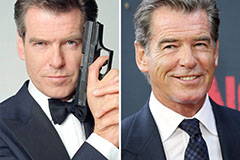

Catherine Bach Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!